Suddenly, you get a call from a bill collector wanting you to make a payment on your overdue loan that’s not even your loan! And bear in mind that you generally don’t even know this is happening… until you possibly start noticing strange things down the road once it’s too late. These are some of the typical uses but there are plenty of others that can destroy you as well.

Opening a bank account and writing bad checks… all in your name.Opening up a credit card for themselves under your name.Getting a bank loan for themselves under your name.Between that trainwreck and the others that we’ve become accustomed to all too often, it’s a safe bet to just assume your information is out there on the dark web.Īnd with your personal information potentially in the hands of thieves, what are some of the most profitable things for them to do with it? Here are a few of the more common possibilities: The 2017 Equifax breach, which they were really never even punished for, was the nail in the coffin for almost everyone. Unfortunately, I think we’ve become numb to the regularity of all the data breaches that keep compromising our personal information. Understanding the importance of a credit freeze

Transunion freeze left how to#

So today I’ll take you through why freezing your child’s credit is important and how to do it. It’s just one less thing now that we need to worry about with our daughter’s financial future. I’m not proud that it took so long to make it happen, but regardless, I just got done it all done. I’ve known that for years and it’s the big reason I ended up putting this task off for a couple of years. Honestly, it’s a little bit of a pain in the butt. So that’s all well and good, but freezing your child’s credit isn’t as simple to do. That last part’s important because we tend to apply for new credit cards several times per year to take advantage of the travel rewards. It wasn’t hard to do (it’s even easier now) and it’s quick and easy to thaw it temporarily when applying for new credit.

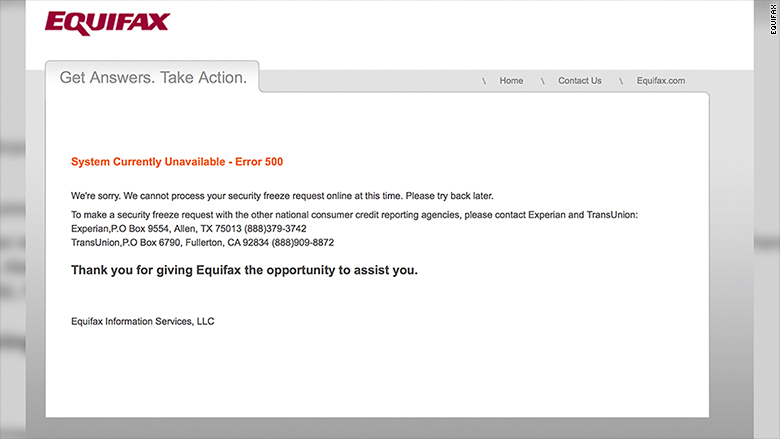

Lisa and I have had our credit frozen since 2017. However, this article is about freezing your child’s credit and why it’s just as important, if not more important, than freezing your own. To those still feeling left out by either company after this spate of news, I have only one thing to say (although I feel a bit like a broken record in repeating this): Assume you’re compromised, and take steps accordingly.If you haven’t frozen your credit yet, I’ll be harping on why you need to do that shortly. At the same time, Equifax’s erstwhile CEO informed Congress that the breach was the result of even more bone-headed security than was first disclosed. Meanwhile, big three credit bureau Equifax added 2.5 million more victims to its roster of 143 million Americans who had their Social Security numbers and other personal data filched in a breach earlier this year. It was more like three billion (read: all) users. Yahoo! announced that, our bad!: It wasn’t just one billion users who had their account information filched in its record-breaking 2013 data breach.

Well buck up, camper: Both companies took steps to make you feel better today. Maybe you’ve been feeling left out because you weren’t among the lucky few hundred million or billion who had their personal information stolen in either the Equifax or Yahoo! breaches.

0 kommentar(er)

0 kommentar(er)